Feb 12, 2026

Arnon Shimoni

Over the past 18 months I've spoken to over 250 AI companies, and I'd say about 3/4 say they don't know how to price their product. I understand why.

There is no playbook - because you can't fit "good better best" and seat pricing onto it like SaaS - but there is a decision tree and a set of hard questions you can start answering today.

Every few weeks, another VC publishes "The Definitive AI Pricing Framework". Most recently, Bessemer did it. Simon-Kucher did it. Kyle Poyar and I wrote one last year about it. They're all useful but none are "copy-paste" and easy to deploy because AI pricing isn't a billing decision.

It's a statement about what you believe your product is worth. And that answer is different for every company, every product type, every customer segment, and every stage of maturity.

What I will give you today is something more practical than a framework, a set of "where are you now?" questions that route you to concrete actions over some timeframes.

And just know, you're going to get this wrong at first. Everyone does.

What to understand and process first

Yes, traditional SaaS had 70-85% gross margins. You could underprice, over-provision, and figure it out later.

That era is over (read one of the 12,000 posts about the "SaaSpocalypse" just this week).

Yes, AI products carry real marginal costs because every inference has a price tag that is much higher than the CRUD apps of yore.

I estimate that AI companies are running at 30-40% gross margin, while some others think it's 50-60%. Either way, it's lower. In SaaS, seat pricing was a growth lever.

In AI, pricing is a survival mechanism. If the math doesn't work at 10 customers, it won't at 1,000 either.

Simon-Kucher's Abde Tambawala nailed the diagnosis: AI is not eliminating the value of software. It is reshaping where value accrues, how it is expressed, and how it must be monetized. The SaaS story isn't over.

But the easy SaaS era is.

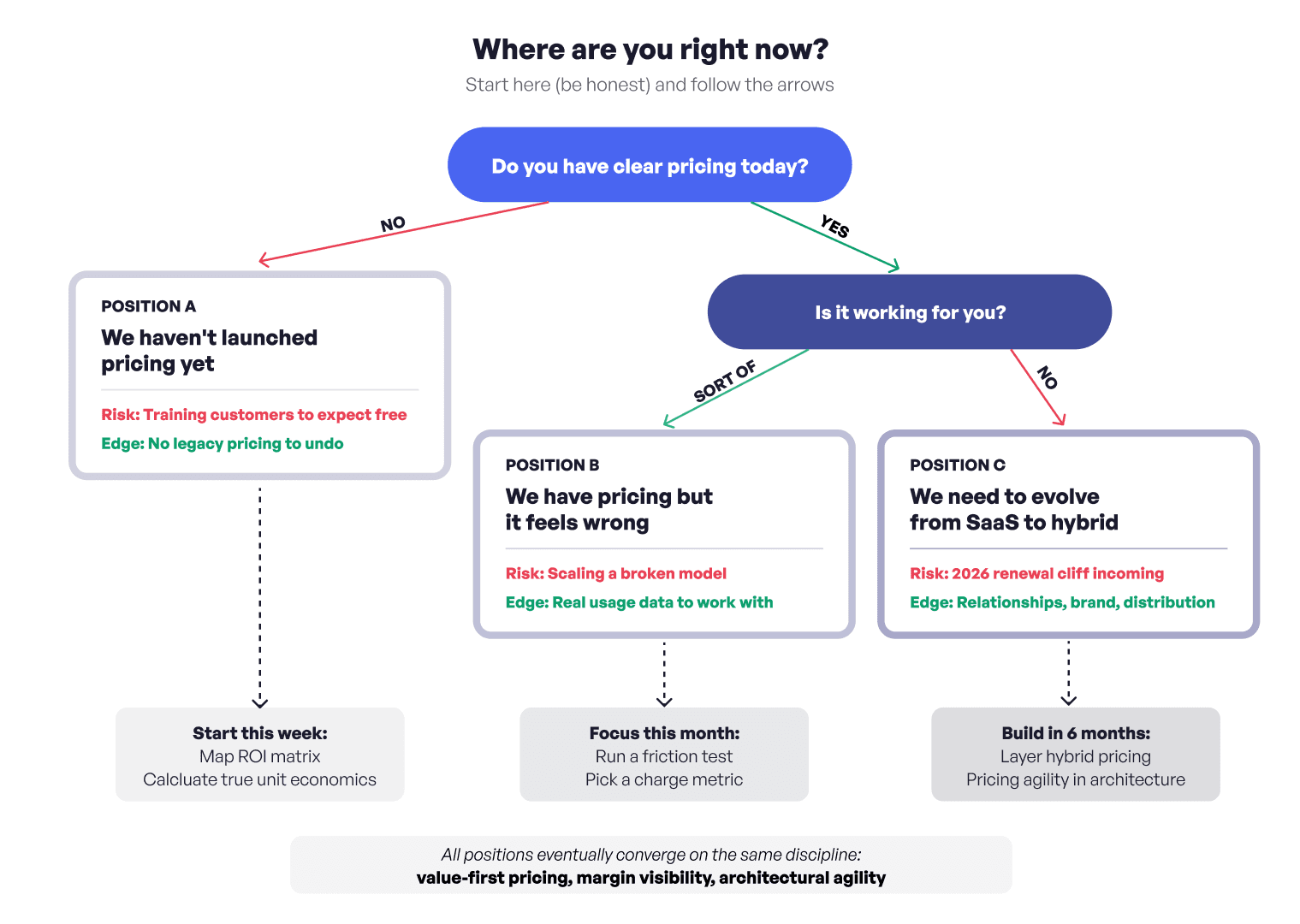

Let's diagnose - where are you right now?

Before choosing a pricing model, you need to know which problem you're actually solving.

I found three starting positions. Be honest about which one is yours.

Position A: "We haven't launched AI pricing yet"

You're pre-revenue or in free beta.

You have a product that delivers value but you haven't put a price on it. Maybe you're afraid of charging too much. You could also be afraid of charging at all.

Your immediate risk: You're training customers to expect free. Every month of free usage makes the conversion to paid harder.

Your advantage: You have no legacy pricing to undo. You can get this right from the start.

→ Go read about what to do this week

Position B: "We have pricing but it feels wrong"

Revenue is coming in, but something's off. Maybe customers say "sold" too quickly (you're underpriced). Maybe your heaviest users are your least profitable. Maybe sales is cutting custom deals that finance can't reconcile.

Your immediate risk: You're scaling a broken model. Every new customer compounds the problem.

Your advantage: You have usage data. You know what customers actually do with your product.

→ Go read about what to do this month

Position C: "We need to evolve from SaaS to hybrid"

You're an established SaaS company that's added AI features. Your seat-based pricing doesn't account for variable inference costs. Your AI power users subsidize your light users, and you can't see where the margin is.

Your immediate risk: The 2026 renewal cliff. Companies that ran AI pilots in 2025 are hitting their first renewal cycles. Pricing that was "good enough for a pilot" will get scrutinized at renewal.

Your advantage: You have customer relationships, brand trust, and distribution. You just need the right monetization architecture.

→ Read everything below, but pay special attention to the longer term

———

Time to decide: what are you actually selling?

Before you touch a spreadsheet, answer one question: What unit of value does your customer care about?

There are three layers, and each trades cost predictability for value alignment.

Low level stuff: Consumption (tokens, API calls, minutes)

You charge for raw resource usage.

In this level, every call, every token, and every inference has a known cost. Your margins are clean and predictable (if you track them, that is).

The problem: Customers don't think in tokens. They think in problems solved. Consumption pricing works for technical buyers who want granular control (e.g., developers building on your API, data engineers optimizing pipelines).

For everyone else, it's a translation problem that I strongly advise against - because you lose transparency and ultimately trust here.

Who does this well: Infrastructure companies. API-first products. Developer tools where the buyer is also the user.

The trap: This is the lowest-differentiation model. You're essentially a commodity. Prices only go down.

It should be no secret that I don't like this model at all for most companies. It's a danger zone.

Workflows (completed tasks, processed documents, meetings booked)

You charge for discrete units of work - e.g., a spreadsheet analyzed, a contract drafted, a lead researched, a meeting booked.

Customers understand what they're buying. They can calculate time saved.

The problem: Cost variability increases. In some cases, a document analysis might require 10x the compute of another. You need enough volume to smooth out the variance or risk confusing the customer.

Who does this well: Vertical AI products with bounded task complexity like sales automation, document processing, and customer support products.

The trap: If the workflow is standard (like account research or email drafting), you're exposed to price compression from competitors. Complex workflows give you more moat to defend but are harder to price.

Outcome (resolved tickets, won cases, recovered revenue)

This is my holy grail, but it's not for everyone.

You charge for results. Intercom's Fin charges $0.99 per ticket their AI actually resolves (not per message sent, not per token consumed). If it takes three messages or thirty, the customer pays the same.

The problem: You absorb maximum cost variability. A difficult issue could consume far more compute than anticipated. You need confidence in your AI's performance and enough volume to average out the extremes.

Who does this well: Companies with measurable, unambiguous success metrics. Customer support resolution. Legal document generation. Compliance processing.

The trap: Outcomes can be hard to attribute. If you're an AI SDR, did your agent book the meeting, or did the prospect just happen to be in-market? Without clear attribution, outcome pricing becomes a fight.

Moving up towards outcomes

As you move from consumption → workflow → outcome, you accept more cost risk in exchange for tighter alignment with what customers actually value. The best founders don't choose based on what's easiest to implement. They choose based on what customers will pay for, and they build the operational discipline to make it work.

Most early-stage companies should start with hybrid: a base platform fee that covers infrastructure costs, plus usage or outcome credits that scale with value delivered.

I don't believe that this is a cop-out - it's a middle ground that gives customers predictability while giving you upside as they scale.

———

Our decision tree for diagnosis

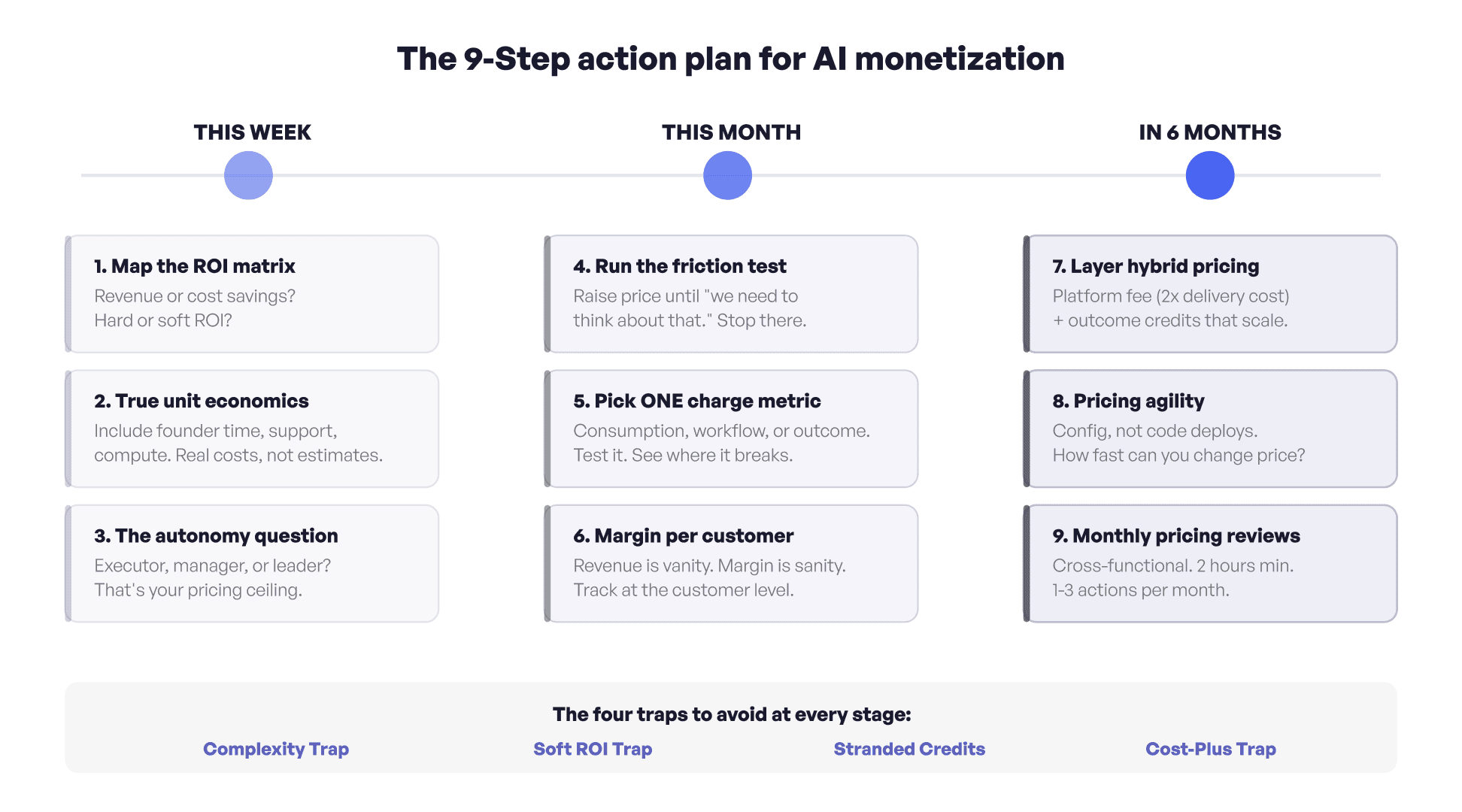

Practically: what to do this week

These are concrete actions.

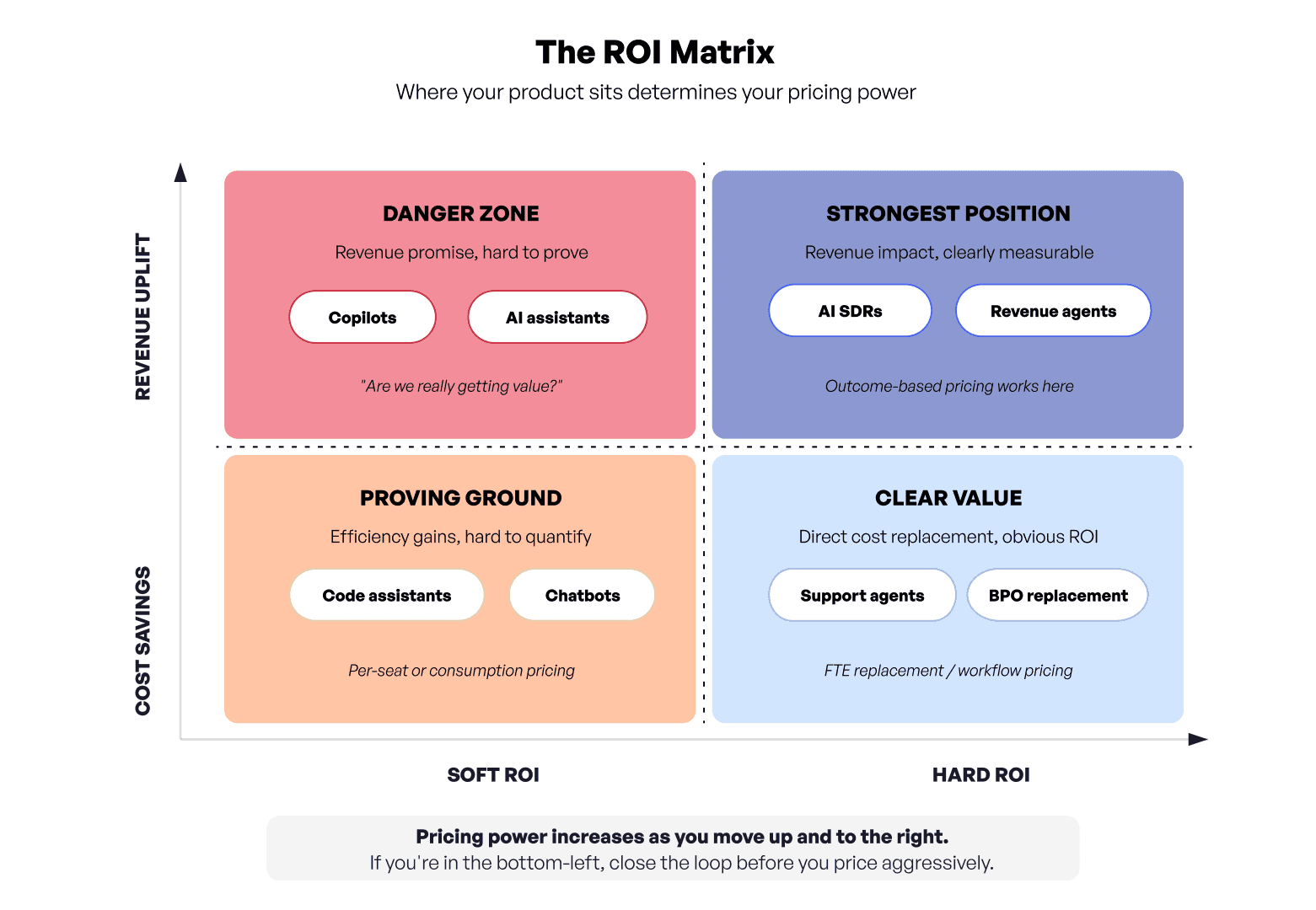

1. Map your product on the ROI matrix.

Create a matrix with two dimensions:

Does your product drive revenue uplift or cost savings?

Is the ROI hard (measurable, undeniable) or soft (incremental, harder to quantify)?

If you're a "copilot" that offering advice without closing the loop, you're in soft ROI territory. That's dangerous for monetization and worse for renewals, because it's gotten hard to prove your value.

If you're an agent that executes entire workflows autonomously, you're in hard ROI territory with stronger pricing power.

You need to know where you sit because it determines everything downstream.

2. Calculate your actual unit economics

Try to get as real as you can. If your CEO spends half their time selling, allocate that. If your CTO answers support tickets, account for the drag.

Include compute, human-in-the-loop expenses, customer success overhead, and sales allocation.

If the unit economics don't add up now, they'll surprise you badly later.

3. Answer the autonomy question

What would your customer pay for if they never saw a dashboard?

As AI and AI agents specifically mature, software stops behaving like a tool and starts behaving like a teammate. We price tools and teammates very differently.

When an executor assists humans value is incremental.

If a manager coordinates work, the value shifts to throughput and consistency.

A leader typically owns the outcomes and that value is measured in responsibility and trust.

Where is your product on this spectrum?

What to do this month

4. Run a friction test

Start with a price. If customers immediately say "sold" you're too cheap. It may seem obvious, but you need to know.

Raise incrementally until you hear "we need to think about that" and stop before it becomes a blocker that cuts you out of the conversation entirely..

This is how multi-billion dollar companies found their sweet spot. Most founders default to cost-plus (calculate costs, double it) because asking for more feels awkward.

You don't need Simon Kucher for that ;)\

5. Pick a charge metric

Don't try to build a hybrid model yet!

Pick consumption, workflow, or outcome. Test it. Get 10-20 customers on it. See where it breaks and what you didn't expect.

Yes, many companies go extremely complex and it sucks. Start simple and stay disciplined!

6. Track margin per customer, not just revenue

If you don't know which customers are profitable and which are subsidized by others you won't know how to price everything in.

This is especially critical for AI products. Variable inference costs mean your most active customer might be your least profitable one. You need visibility at the customer level, not just in aggregate.

What to do in six months

7. Layer in hybrid pricing

Once you've validated a single charge metric, add the second dimension.

You could go for something like a platform fee plus outcome credits, or a base subscription plus usage tiers. One thing we've seen many times at Solvimon is something along the lines of:

Platform fee (2x your calculated delivery costs) + outcome credits that scale.

As the outcomes increase, your per-outcome cost falls but total revenue from the customer could grow. That's natural expansion with healthy margins.

8. Build pricing agility into your architecture

How fast can you change pricing without an engineering sprint? If the answer is "weeks" or "months", you have an architecture problem, not a strategy problem and you should talk to us.

If your pricing is hardcoded, every experiment requires engineering. So you don't experiment. And you leave money and customer alignment on the table.

9. Run monthly pricing reviews

Listen, seriously - monthly. Cross-functional: product, finance, sales, GTM - with a holistic view of what happens. You want to run this like a roadmap, and preferably aligned with your product team.

This is what treating monetization as a first-class citizen looks like. Avoid the pricing committee where nothing gets done!

The four traps that we've seen kill AI pricing

The complexity trap

You start with one model, but then your sales people close an excellent deal.

SLG over PLG - but then enterprise wants something different.

Suddenly you have nine pricing approaches across different contracts and no way to reconcile them. What worked at seed becomes a liability as you get to Series B or expand globally.

The soft ROI trap

Tools that offer advice without closing the loop live in dangerous territory as we've discussed earlier. Customers question whether they're getting value. As pilots you started in 2025 hit renewals this year, the AI Mandate to buy anything isn't enough anymore. Your GTM and pricing must reflect actual outcomes, not just the inputs or "promises" of getting better.

The stranded credits trap

AI pricing models that mix seat-based licensing with per-user credit allotments create stranded assets.

When companies pay for large pools but can't actually use them because credits are locked to individual users, you get artificial breakage that benefits vendors like yourself in the short-term but erodes trust and accelerates churn. Just ask Figma.

The cost-plus trap

You calculate your inference costs, add a margin, and call it pricing. This is the most common mistake and the most expensive one. Lead with value. What problem are you solving? What's the alternative cost (headcount, manual process, existing vendor)? Price relative to that, not relative to your GPU bill.

The bottom line

I think we all understand there is no universal AI pricing playbook. Not right now anyway.

But there are patterns you can recognize and act on.

Consumption pricing commoditizes you.

Workflow pricing is defensible if the workflow is complex enough.

Outcome pricing is the strongest position but requires confidence in your AI's performance and clear attribution.

Start with value (not cost), measure obsessively (margin per customer, not just revenue), and build architecture that lets you iterate (configuration, not code).

Your pricing is a statement about what you believe your product is worth.

Make it a bold one. You will get it wrong, fix it, and maybe even get it wrong again. The only actual mistake is treating pricing as a one-time decision instead of a continuous discipline.

———

This framework synthesizes analysis from 60+ AI agent companies, Bessemer Venture Partners' research, and Simon-Kucher's SaaS value stack work. None of them agree on everything. That's the point.