Nov 4, 2025

Kim Verkooij

The VAT nuance that matters more than you think

In the evolving world of digital services and AI monetization, few topics are as misunderstood — yet as financially impactful — as the VAT treatment of credits, tokens, and prepaid balances.

At first glance, these all look like simple advance payments. But under EU law, some of them unlock a real (and legal) indirect tax benefit: delayed VAT payment, improved cashflow, and no tax on unused balances.

The difference lies in a small but powerful distinction — between a prepayment and a voucher.

The “voucher law” that standardized EU treatment

Before 2019, EU Member States applied wildly different VAT rules to vouchers. Some taxed them on sale, others on redemption, creating double taxation or gaps.

That changed with EU Directive 2016/1065, often nicknamed the “voucher repair law.” It amended the VAT Directive to create a single, harmonized framework — defining:

Single-Purpose Vouchers (SPVs): where the place of supply and VAT due are already known at issuance.

→ VAT is payable immediately on sale.Multi-Purpose Vouchers (MPVs): where either the VAT rate or the place of supply is not yet known at issuance.

→ VAT is payable only on redemption.

That seemingly technical distinction creates a major cashflow difference — and for digital businesses, potentially millions in timing advantage.

Prepayment vs voucher: the true dividing line

To understand the benefit, you have to start with Article 65 of the VAT Directive, which says:

“Where a payment is made on account before the goods or services are supplied, VAT shall become chargeable on receipt of the payment.”

In other words: for prepayments, VAT is due as soon as money changes hands, even if the service hasn’t been delivered yet.

But vouchers are carved out as a special regime. Once a payment qualifies as a voucher, Article 65 no longer applies — instead, VAT is triggered by the voucher-specific rules (Articles 30a–30b).

Here’s the crucial test:

Question | If the answer is “yes”… | VAT timing |

|---|---|---|

Do we know exactly what is being supplied, where, and at what VAT rate? | It’s a prepayment (Art. 65). | VAT now — on payment or invoice, whichever comes first. |

Is any of that still uncertain — e.g. multiple services, mixed VAT rates, unknown use? | It’s a voucher (Directive 2016/1065). | Depends on SPV or MPV |

Applying this to GenAI credits

Now consider the business model used by providers like OpenAI, Mistral, or Anthropic. Customers often purchase €100 in credits to consume over time across different AI services — chat, code, image generation, embeddings, etc.

If we look through a VAT lens:

The customer pays upfront,

The supplier (AI platform) knows the customer’s profile and location,

But the actual supplies (which services, when, where, and even by whom) are not yet known.

That means the credits are not a prepayment for a specific supply. They’re an instrument redeemable for multiple potential services — in other words, a multi-purpose voucher (MPV).

The indirect tax benefit in numbers

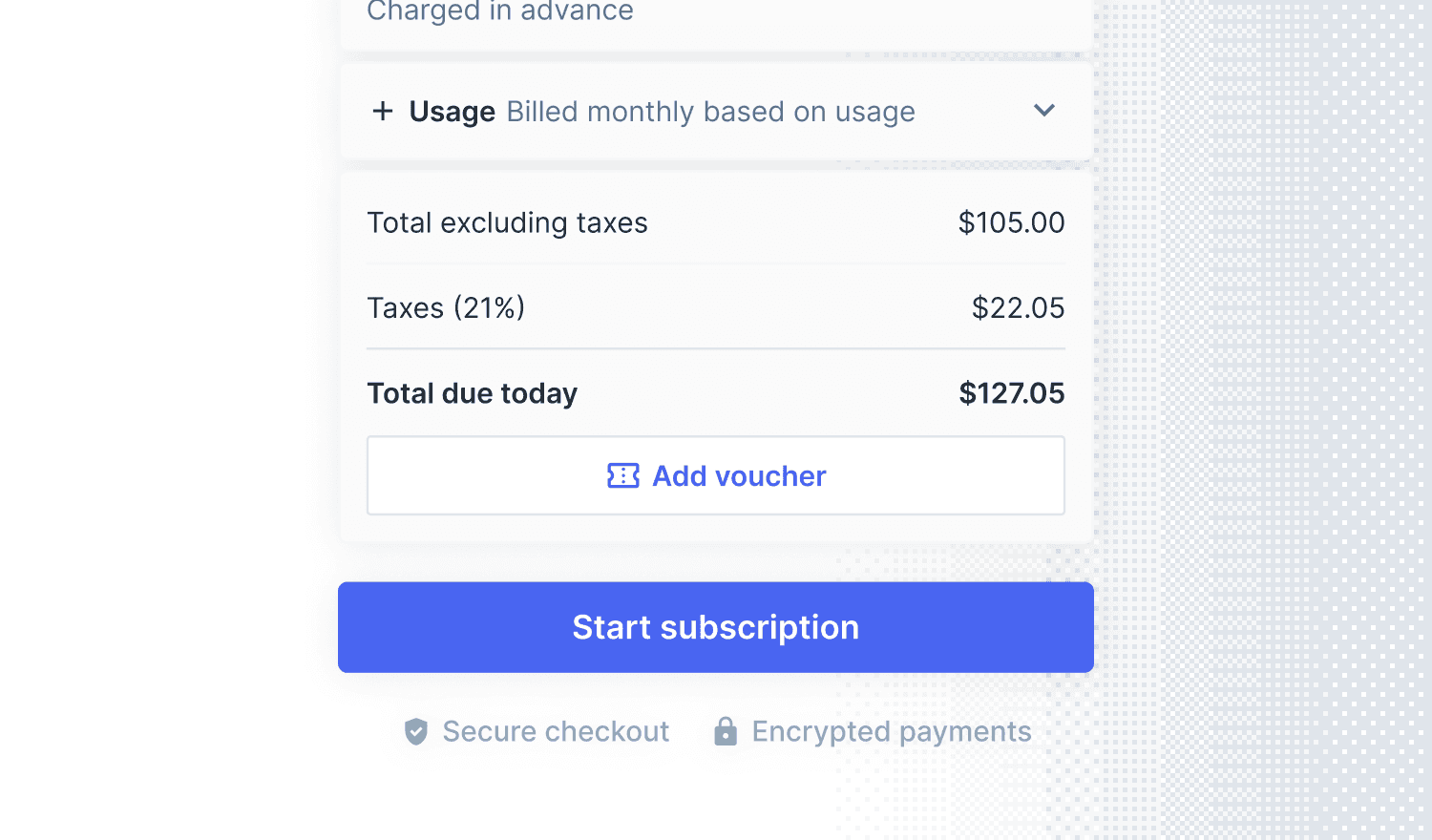

Let’s use a simple example:

Scenario | Amount (€) | VAT (21 %) | Timing |

|---|---|---|---|

SPV or Prepayment – specific known service | 100 | 17.36 | VAT due immediately |

MPV – credits for multiple possible services | 100 | 17.36 | VAT due only when redeemed |

Now add two dynamics common in prepaid credit models:

Redemption delay — on average, customers use their credits over several months.

Breakage — some credits never get used at all.

For an MPV, that means:

You hold the full €100 until redemption (cashflow advantage).

VAT is paid only when the service occurs (deferral).

Expired credits generate no VAT liability at all (permanent benefit).

For a large SaaS or AI provider with thousands of customers, this isn’t trivial — it’s a structural improvement in working capital efficiency.

The line between MPV and SPV is thinner than it looks

Could those same GenAI credits ever become single-purpose vouchers (SPVs)?

Yes — but only if, at the moment of sale:

The VAT rate and place of supply are fixed and known, and

The credits can only be redeemed for one taxable service type.

That’s rarely the case in practice. Even if every service is taxed at 21 %, the certainty test under the Directive requires that VAT be fully determinable at issuance.

Any uncertainty — about the customer’s location, service type, or potential use — keeps it in MPV territory.

What about prepaid invoices?

If you issue an invoice for a specific, known supply (say, “10 million API calls for text generation”), that’s not a voucher at all.

It’s a prepayment under Article 65 — VAT is due when paid or invoiced, whichever comes first.

This is why legal and accounting clarity matters:

“€100 credit balance” → MPV → VAT on redemption.

“€100 advance invoice for API service” → Prepayment → VAT on payment/invoice.

The CFO takeaway

Getting this right isn’t just a compliance issue — it’s a cashflow optimization strategy.

For businesses built on credit balances, prepaid usage, or stored value, the classification determines:

When you owe VAT (immediate vs deferred),

How you recognize revenue, and

Whether expired balances quietly improve margin.

The practical decision tree

Here’s a simple framework for tax and finance teams:

Customer pays in advance

Is there a redeemable credit / token / balance?

No → Prepayment → VAT now (Art. 65)

Yes →

Are the supply and VAT fully known at payment?

Yes → SPV → VAT at issue

No → MPV → VAT on redemption

A closing thought

The EU’s “voucher law” was designed to fix mismatched VAT rules.

But for digital businesses — especially those selling credits or usage-based AI access — it also created a quiet structural advantage.

Classify correctly, document clearly, and your tax timing can move from instant payment to just-in-time.

In a high-growth environment where cash efficiency is king, that’s a compliance insight worth far more than 21 %.

✳️ About Solvimon

At Solvimon, we help companies monetize usage-based products — from pricing to billing to tax automation. Understanding these nuances isn’t just about compliance; it’s about designing financial infrastructure that scales intelligently with your business.