Jan 19, 2026

Arnon Shimoni

In 2026 it's clear that credits are how AI gets monetized.

Every AI company today, whether they're selling API calls, agent actions, or model outputs has landed on some version of credits and tokens.

On the one hand, they're fairly flexible. They abstract away the complexity of variable compute costs - and customers understand them (vaguely, sometimes).

If you ask a CFO who's selling an AI product however what their margin is on a specific customer, the answer is almost always: "uh, let me get back to you".

Sometimes it'll take days, sometimes weeks. Often, they get bored of trying to find out and they give up.

We call this problem The Spreadsheet in the Middle, or SitM.

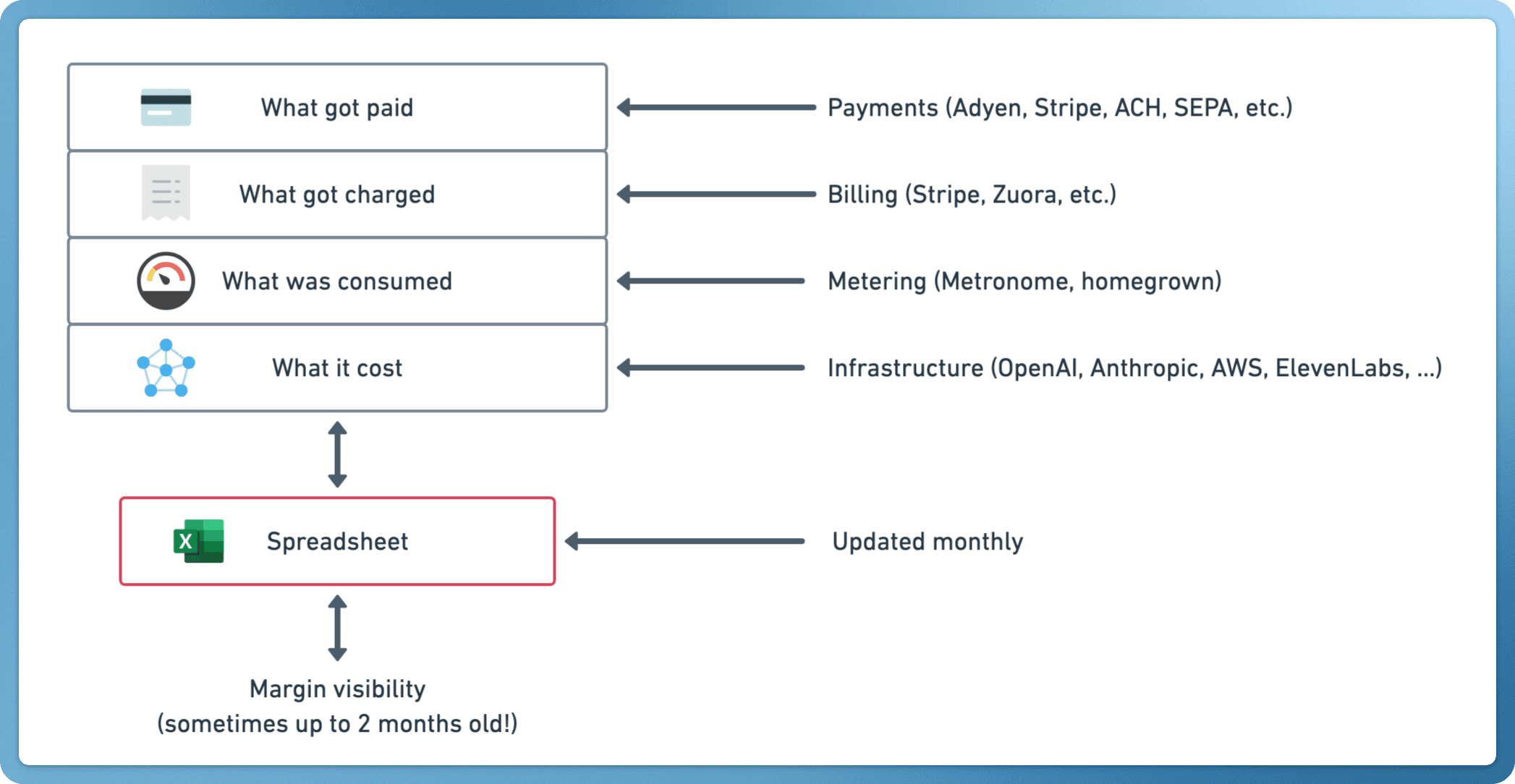

A common AI monetization architecture

Here's the architecture most AI companies are running, by layers

A payments system (like Adyen, Stripe, or some invoicing mechanism)

A billing system (Stripe, Chargebee, Zuora) that knows what you charged

A metering tool (Metronome, Orb, or something homegrown) that knows what was consumed

Infrastructure invoices (OpenAI, Anthropic, AWS, ElevenLabs) that know what it cost

Four system, three sources of truth.

Often, the way to connect them up is a spreadsheet, meaning you now have five systems.

Honestly, you shouldn't feel embarassed by it. It happens to a lot of companies - both small and big. They're updated monthly if you're lucky, often reconciled by hand.

However, while not unusual - the outcome is unfortunately margin visibility that's stale.

We call this the Spreadsheet in the Middle (SitM), and it's become the tax on AI monetization.

Do you have a problem?

The diagnostic to understand the problem is relatively straightforward.

Pick a customer, and ask:

What's my margin on Customer X?

Which AI model is most profitable for this customer? (Can we swap it out?)

Am I losing money on my top 10 accounts?

If you can't answer these questions without pulling data from multiple systems and running an analysis that takes a few hours - you may have a SitM problem.

Again, you're not alone. This is the default state for most AI companies we speak to today, because the billing infrastructure wasn't built for credits and payments and reconciliation and…. so many more things that show up.

This gets complex with B2B setups

Unlike normal B2C setups where one customer has one set of credits, SitM creates a second problem: stranded assets.

When Figma rolled out AI credits, the reaction from one contract owner we spoke with wasn't excitement. It was: "This is theft. I'm paying for pools of credits that will never be used, and I can't move them around."

Ouch. That's because credits allocated per user, not per organization - which can often be a complex multi-entity setup.

Power users (which are estimated at 10-20% of a customer's users) often burn through their allocation in a few days and hit a wall.

Casual users (up to 90%) sit on credits that expire unused.

As an organization, you negotiate a good deal for a lot of credits, but your end-users can only access a fraction of them as the rest are locked in the "wallets" of people who never log in.

It's profitable for vendors in the short term. It's a churn accelerant in the long term as seats and users get deactivated for this reason.

The architectural fix is straightforward: pool credits at the org level, not the seat level. But most billing systems don't support this natively so companies either accept the breakage or build custom logic on top.

More duct tape. And more spreadsheets in the middle.

What companies can do today

The Spreadsheet in the Middle exists because billing, metering, and cost allocation were built as separate systems. The answer isn't better integrations between them. It's one ledger. One system to rule them all 💍.

A credit system that handles:

Consumption and cost in the same system. Not metering in one tool and billing in another. One source of truth for what was used and what it cost to deliver.

Multi-model cost allocation. One credit might cost you $0.002 to fulfill on GPT-4o-mini or $0.02 on Claude Opus. The ledger needs to know the difference automatically, not via manual and ocassional reconciliation.

Margin visibility by customer, by segment, by model. In real-time. Not in a spreadsheet someone updates after month-end close.

Pooled entitlements as a first-class feature. Org-level credit pools, shared wallets, rollover logic, without custom code that encodes exceptions.

Pricing changes that don't require a "quick analysis". When your analysts need data, the answer should take minutes, not weeks.

Honestly, this should be table-stakes for companies serious about monetizing AI.

The SitM era will be ending

It's unwise to bet against Excel as a tool. Spreadsheets definitely got us here, and they aren't going away.

For AI economics however, variable costs per request, multiple models with different price points, and usage limits - that can't be the tool we use.

The infrastructure has to catch up.