Feb 2, 2026

Arnon Shimoni

Pure seat-based pricing is irrelevant for AI. It creates no growth.

Don't be silly though - it didn't "die" because people said it died in a LinkedIn post, it just hasn't created any growth in 2025, and that trend continues in 2026.

Building on our own analysis and others' (Bain's SaaS study, PricingSaaS's Q1 2026 report, and ICONIQ's State of AI), we reach the same same conclusion:

Hybrid is no longer experimental. It's the default.

The numbers

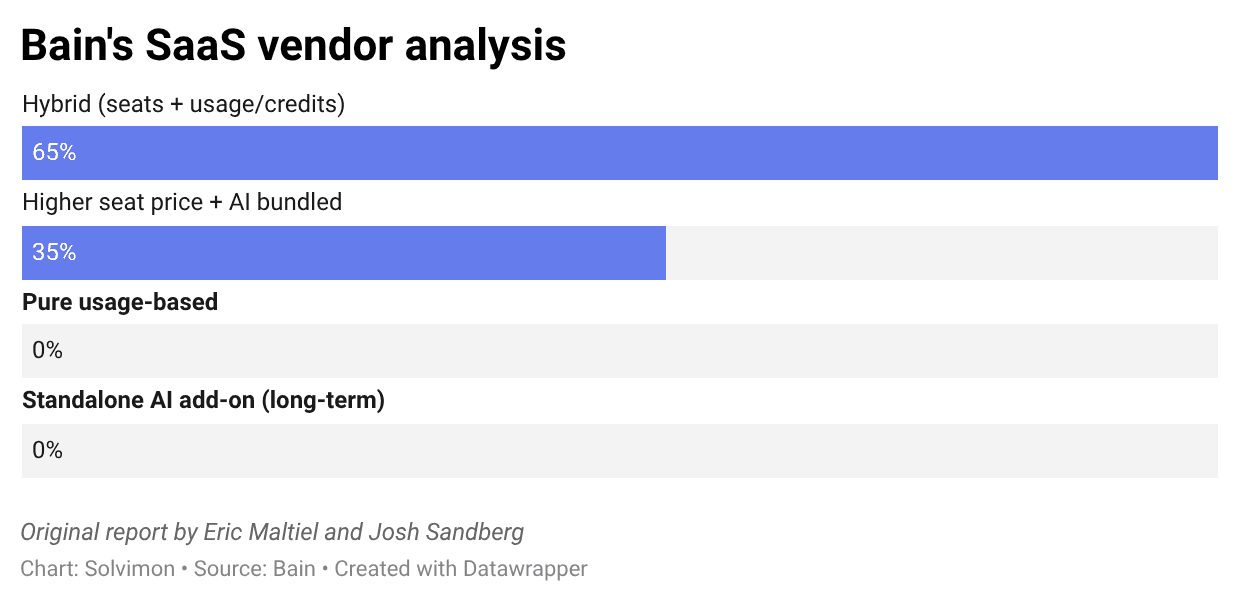

Bain analyzed established SaaS vendors adding AI capabilities:

Pricing strategy | % | Why? |

|---|---|---|

Adopted hybrid models (seats + usage/credits) | 65% | Most common approach |

Raised seat prices and bundled AI into existing tiers | 35% | Because it's a good middle step |

Went pure usage based | 0% | No sustained adoption |

Kept AI as a standalone add-on | 0% | Not viable at scale |

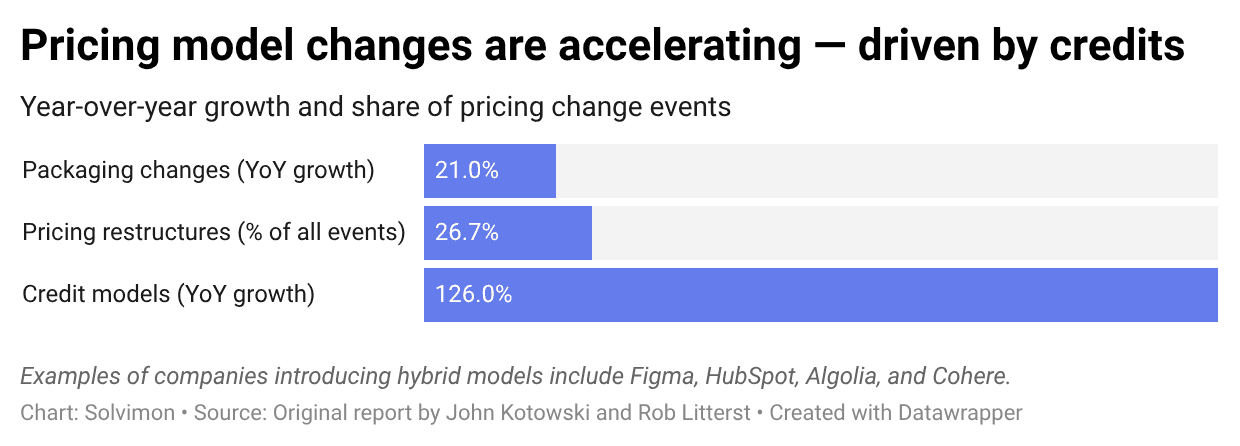

PricingSaaS tracked 498 companies across 8,394 pricing events in 2025:

Credit models surged 126% year-over-year

Packaging changes increased 21%

Pricing restructures were the #1 event type (26.7% of all changes)

Companies like Figma, HubSpot, Algolia, and Cohere all introduced hybrid models

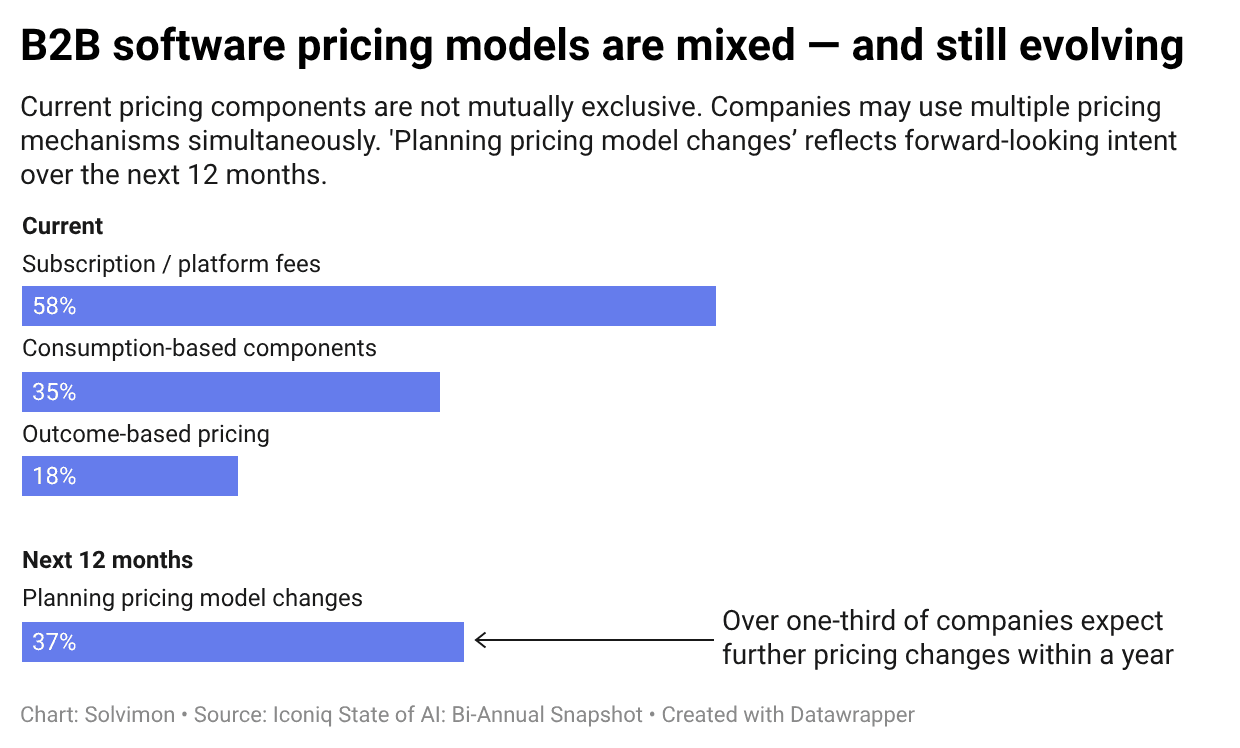

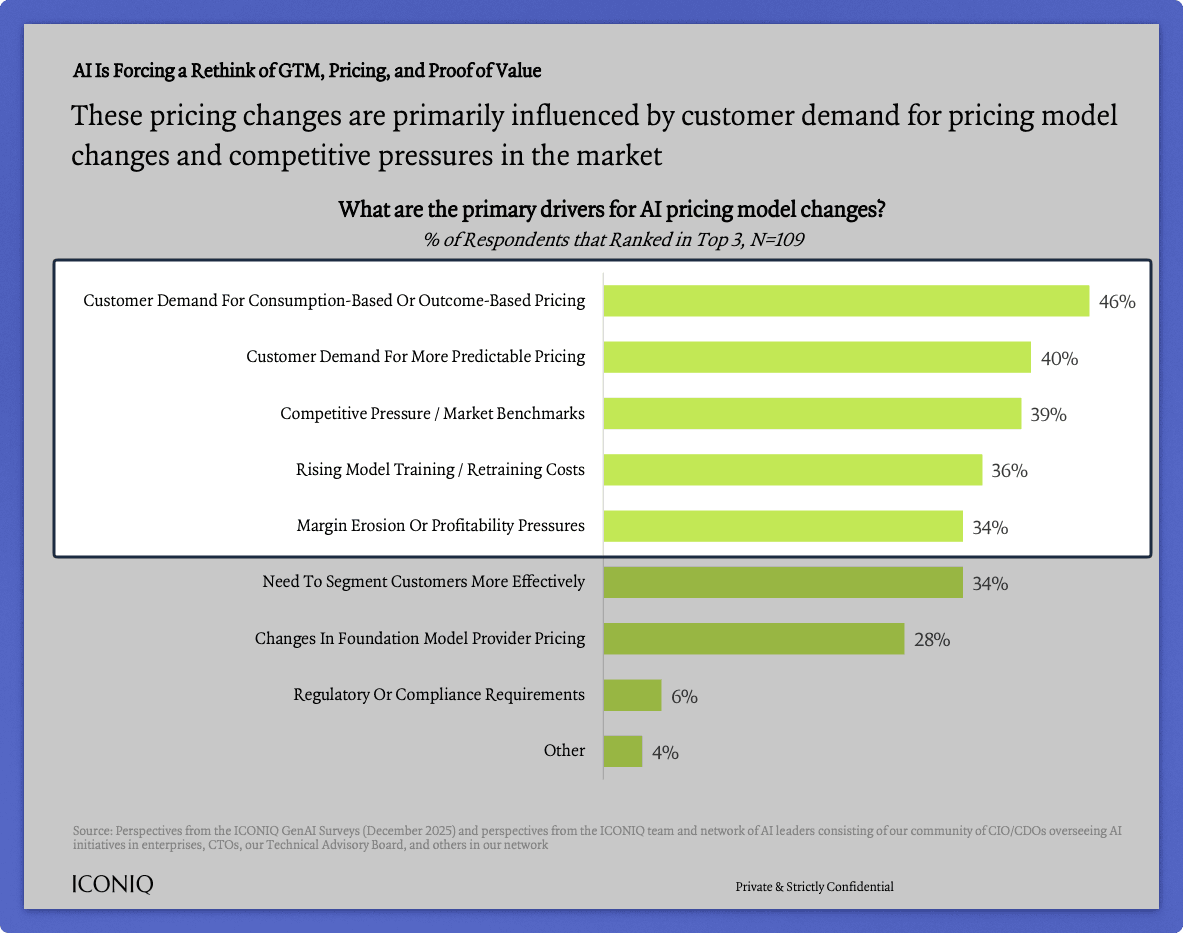

ICONIQ surveyed AI builders in December 2025:

58% still include subscription/platform fees

35% use consumption-based components

18% experiment with outcome-based pricing

37% plan to change their pricing model in the next 12 months

To me, the pattern is clear: companies aren't choosing between seats and usage. They're combining them.

Why is hybrid pricing winning?

As always, this is all down to economics.

AI introduced two structural problems that seat-based pricing can't solve:

Problem 1: Volatile costs. Model inference, fine-tuning, and compute don't scale linearly with headcount. I've seen one AI vendor whose top 5% of users consumed 75% of compute costs while paying a flat fee. That's completely unsustainable.

Problem 2: Value misalignment. When AI automates tasks that previously required humans, charging per-seat stops making sense. The product delivers more value, but the revenue metric doesn't move with the value (and sometimes goes entirely the other way).

Hybrid models solve both in a way most of us can accept:

A platform fee covers baseline infrastructure and feature access

Usage charges protect margins from heavy users

Credits abstract token costs while preserving most of the usage-based alignment

What hybrid looks like

The term "hybrid" is vague. Here's what companies actually ship:

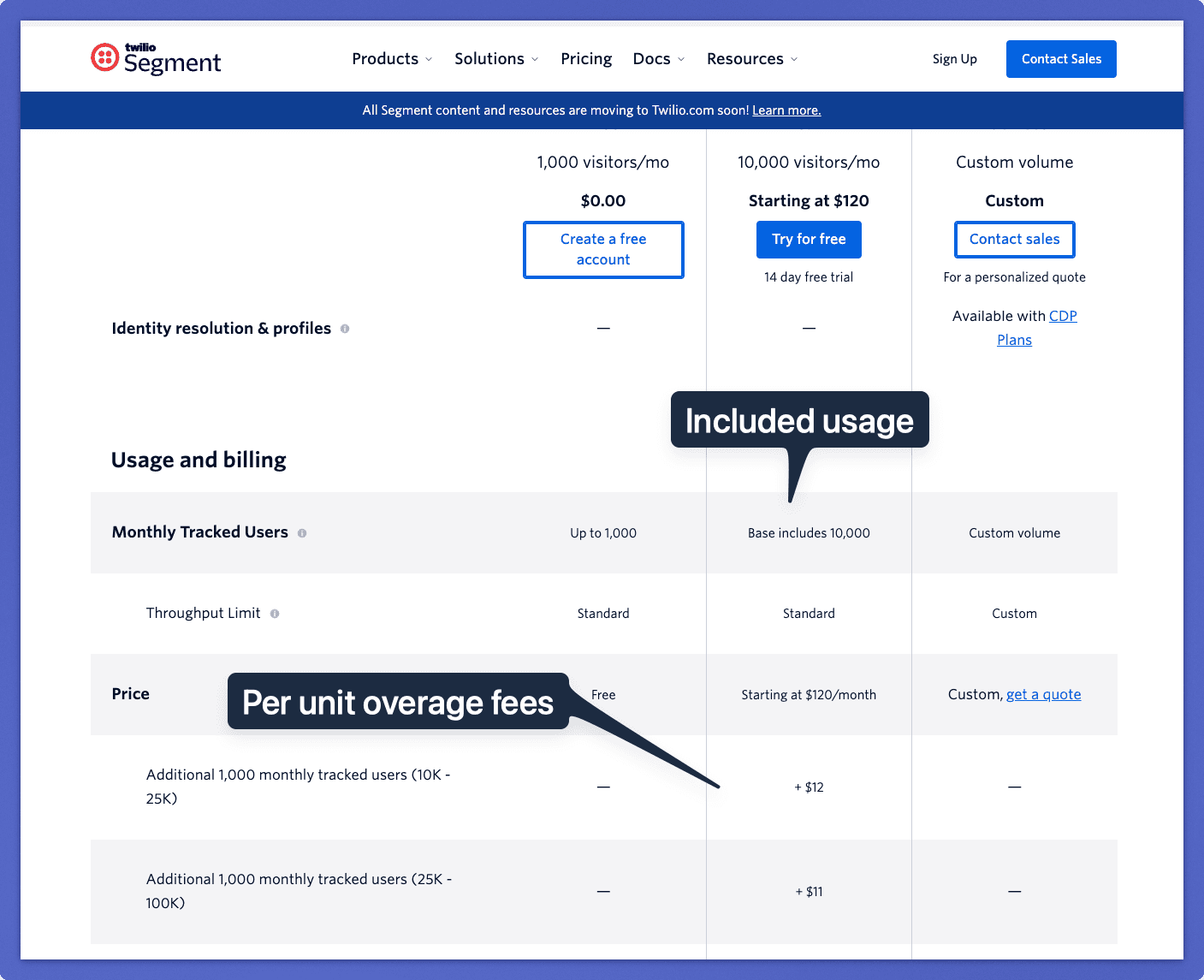

Flat + Limit + Overage (most common)

Base subscription includes X usage per month

Per-unit charges beyond the limit

Example: Cursor, OpenAI Teams, Segment

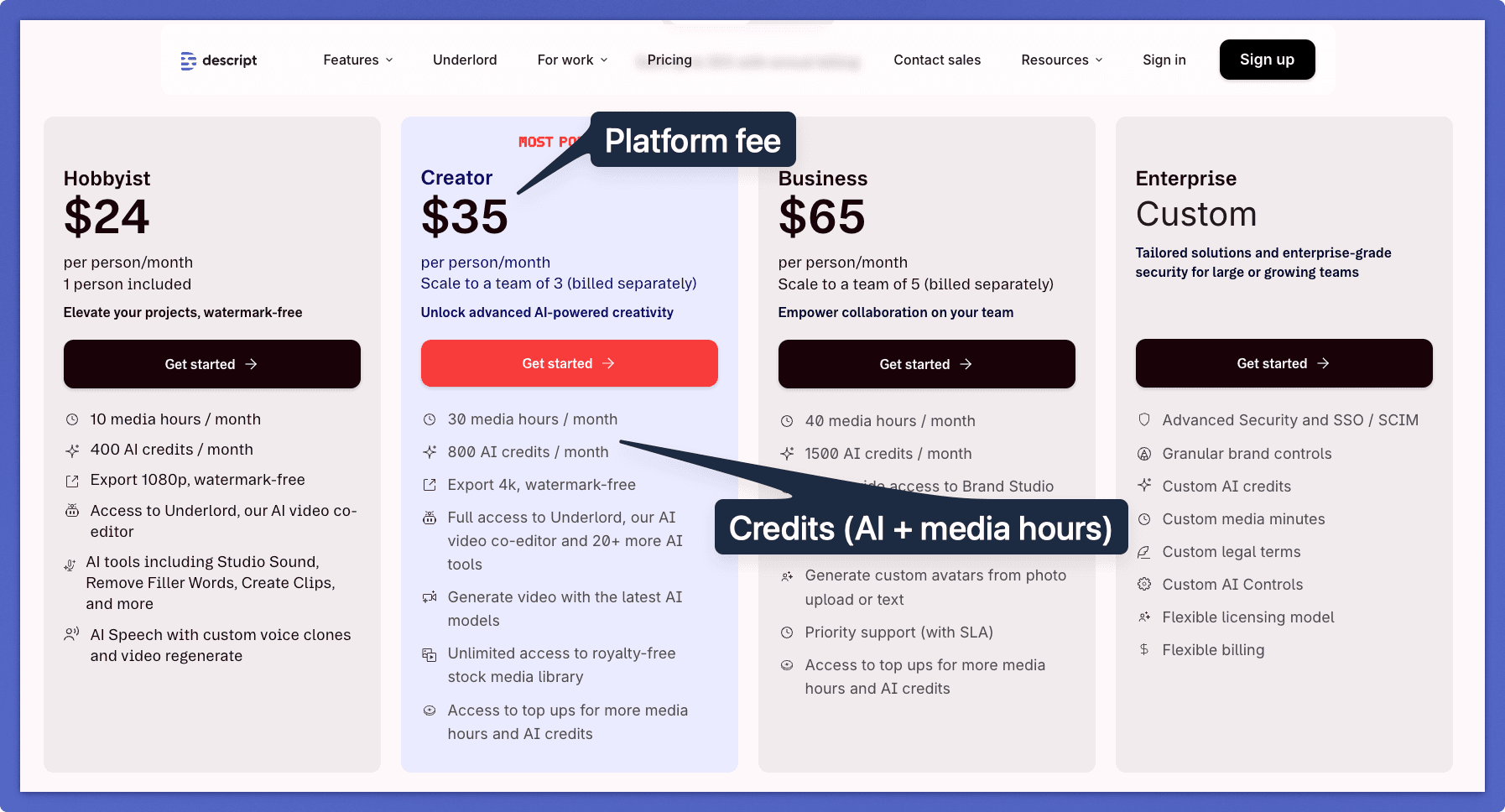

Flat + Credits

Platform fee + pre-purchased credit allocation

Different actions consume different credit amounts

Example: Clay, ElevenLabs, Descript, AssemblyAI

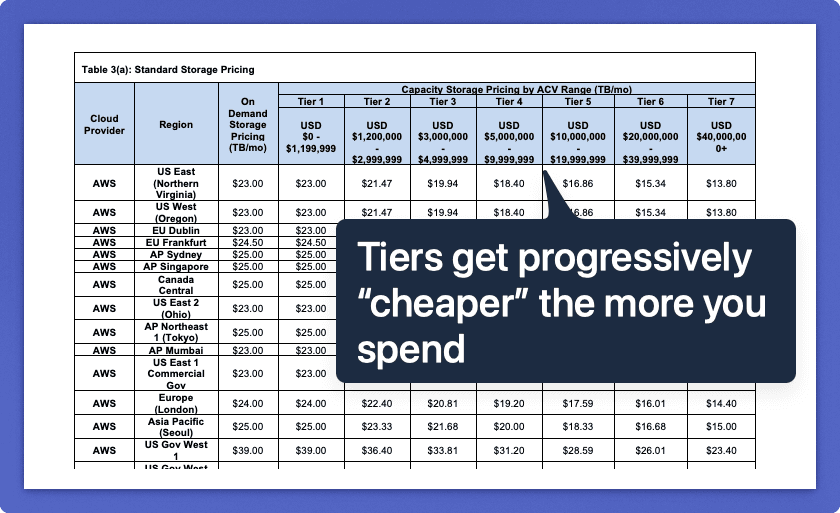

Tiered Commitments

Annual commit drives pricing tier

Usage charged at tiered rates based on volume

Example: Snowflake, Vercel (AI workloads)

The PricingSaaS data shows companies iterating rapidly on these structures.

Cohere changed its pricing metric from "per image" to "per million image tokens".

LaunchDarkly shifted from "experimentation keys" to "experimentation MAU".

Algolia introduced a pay-as-you-go tier at $1.75 per 1K searches.

That's the new normal.

What it means for billing architecture

Hybrid models create architectural complexity that most billing systems weren't designed to handle.

Bain's research found the primary blocker wasn't strategy - it was implementation. We can echo this, as some of our customers delayed pricing changes for years because:

Product catalogs existed in many disconnected systems. Sometimes as many as 7!

Entitlements were hard-coded to plan IDs

Billing systems couldn't support credits or burndown logic

Every pricing change required engineering work

This was true both for entirely home-built systems, but also for systems hacked around Stripe, Chargebee, Zuora, and others.

Vercel ships as many as 6 pricing changes per month, but most companies take 6 months to ship one - not because they don't want to, they just can't.

What Happens Next

ICONIQ's data shows 37% of companies plan to change their AI pricing in the next 12 months. The drivers are clear:

Customer demand for consumption/outcome-based pricing (46%)

Customer demand for predictable pricing (40%)

Competitive pressure (39%)

Margin erosion (34%)

These pressures don't resolve by picking a model once, because they require continuous iteration. It's a pricing and monetization muscle you have to build up.

No one will "get pricing right" - you have to iterate on pricing as fast as you iterate on product. That requires treating pricing as architecture, not a number.

Bottom line

Hybrid pricing is the default because:

AI economics force it (volatile costs, value misalignment)

Customers accept it (predictable base + usage upside)

The data proves it (65-78% adoption across studies)

If you're still running pure seat-based pricing for AI features you're leaving margin on the table.

You have to go hybrid - but can your billing infrastructure can support it?